For the past months I’ve been quietly working on a project and I’m thrilled to finally share it.

If you’ve followed my journey or know my interests, you know I’m fascinated by the public markets. But one area has always felt frustratingly opaque and underserved: stock dilution.

For any investor in growth-stage or small-cap companies, dilution is the silent portfolio killer. You can do all the right research, find a great company, and still see your position’s value get crushed by a surprise secondary offering, an active ATM (At-The-Market) program, or a wave of warrant exercises.

The problem is, tracking this risk is a nightmare. It means manually digging through dense, jargon-filled SEC filings, trying to piece together clues from S-1s, S-3s, and 8-Ks, and building complex spreadsheets to model it all. It’s a full-time job, and the existing tools for retail and even professional investors are surprisingly lacking.

I knew there had to be a better way.

The Solution

That’s why I built Dilution Trackers.

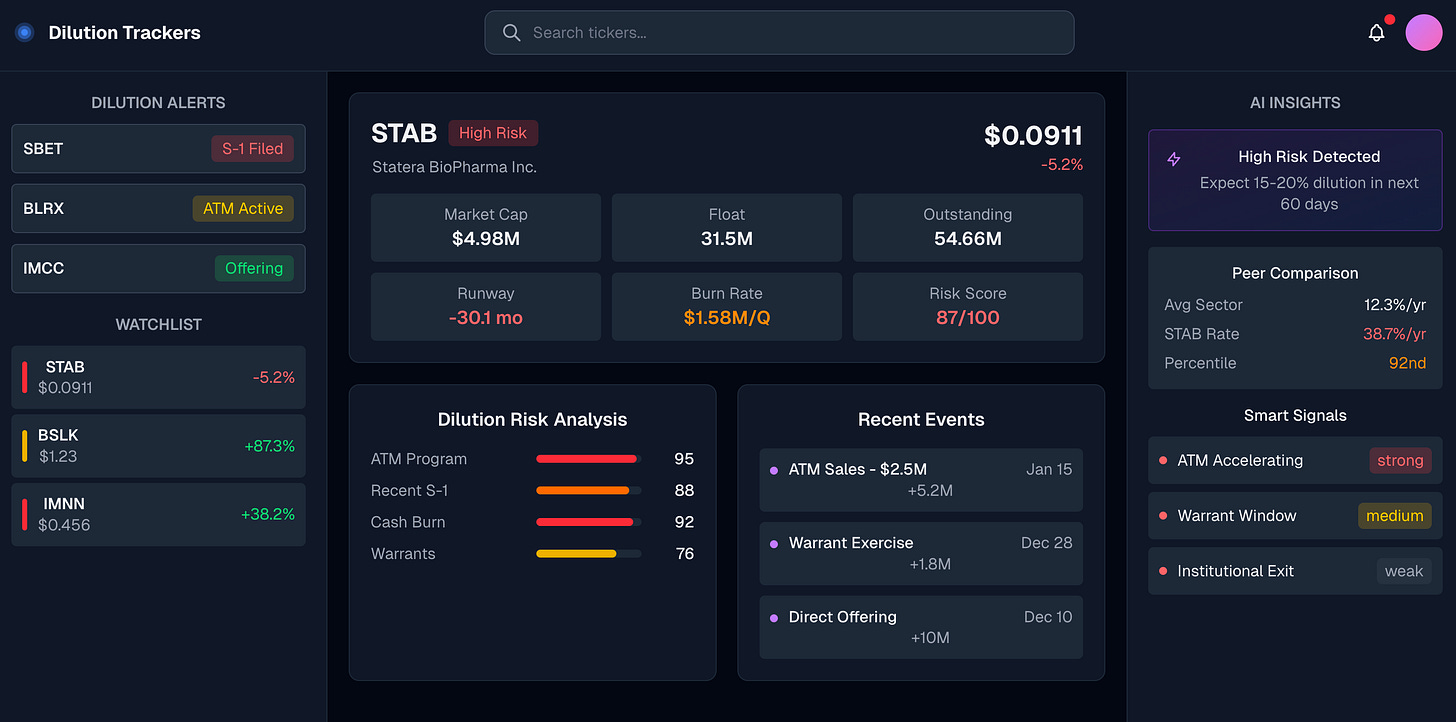

In short, it’s a platform designed to make tracking and anticipating equity dilution events simple, fast, and actionable. We automate the entire process of monitoring thousands of companies for potential dilution, so you can protect your portfolio and make smarter decisions.

We pull data directly from SEC filings and synthesize it with stock information to give you a clear, immediate picture of a company’s dilution risk.

What It Does

Instead of spending hours sifting through documents, you get instant answers to critical questions.

And for the developers and quantitative researchers out there, we’ve built a powerful, easy-to-use API. You can pull all of our clean, structured dilution data directly into your own models, dashboards, and backtesting frameworks. Stop parsing filings and start building.

Who Is This For?

I designed Dilution Trackers for the people who feel this pain the most:

Quantitative Researchers & Developers who need clean, structured data to build and test alpha-generating models.

Financial Managers who need to automate portfolio monitoring and conduct faster, more accurate due diligence.

Check It Out and Let Me Know What You Think

Building Dilution Trackers has been a massive undertaking, and I’m incredibly proud of what the team has accomplished. My goal is to bring a new level of transparency to a corner of the market that has been murky for too long.

Visit the website: https://www.dilutiontrackers.com/

Thank you for all your support, and I can’t wait to hear what you think.

Josh